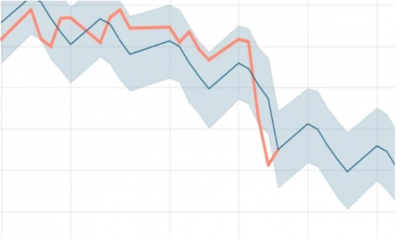

Despite a surge in defaulted loans and deposit repayment failures, top officials in banks continue to enjoy lavish salaries, Bangladesh Bank`s recent report reveals.

The report says the managing directors (MDs) and chief executive officers (CEOs) of private banks, including those struggling financially, are earning millions annually. Private bank MDs are receiving salaries ranging from Tk 10 to 25 lakh per month.

According to Bangladesh Bank`s findings, five private banks are currently in the red zone due to defaulted debts. Bangladesh Commerce Bank, for instance, has defaulted debts amounting to Tk 1,374 crore, with branches failing to reimburse customers. Despite this, the MD`s salary at this bank surpasses eight digits in taka annually.

In the fiscal year 2022-23, the MD of Bangladesh Commerce Bank received a staggering salary of Tk 1 crore 23 lakh 63 thousand, equating to over Tk 10 lakh per month. This marks a significant increase from Tk 96 lakh per annum in the preceding fiscal year, highlighting a rise of over Tk 27 lakh in just one year.

A similar situation is observed at National Bank Ltd, where defaulted loans amount to Tk 12 thousand 368 crores. Despite the financial turmoil, the MD`s annual salary soared to Tk 1 crore 66 lakh 80 thousand in the fiscal year 2022-23, translating to a monthly salary of Tk 13 lakh 90 thousand, up from Tk 96 lakh the previous year, reflecting a staggering increase of Tk 70 lakhs within one year.

ICB Islami Bank, which evolved from Oriental Bank, faces defaulted loans of Tk 687 crore 95 lakh, with the MD receiving a monthly salary of Tk 11 lakh.

Meanwhile, First Security Islami Bank`s MD receives an annual salary of Tk 2 crore 13 lakh 31 thousand, witnessing an increase of approximately Tk 16 lakhs within the year.

Among MDs, the highest earner is at Eastern Bank, with an annual salary of Tk 3 crore 4 lakh 70 thousand, exceeding Tk 25 lakh monthly, compared to Tk 2 crore 48 lakh 41 thousand the previous year.

Commenting on the exorbitant salaries, Salim RF Hossain, Chairman of MDs` Association ABB and MD of BRAC Bank, attributed these figures to the qualifications and overall performance of MDs. However, Khandaker Golam Moazzem, research director of the Center for Policy Dialogue (CPD), emphasized the role of the board of directors in determining MD salaries, urging for stronger monitoring by the central bank.

In response to escalating concerns, Bangladesh Bank has initiated scrutiny into the personal benefits of MDs from four banks – BRAC, City, Dutch-Bangla, and Eastern – to ensure compliance with new directives on salaries and staff layoffs, signaling a stricter stance on financial regulations.